2019 Arizona Individual Income Tax Changes

12-18-2019Tax InformationAre Arizona itemized deductions the same as the federal itemized deductions?

Arizona itemized deductions are the same as the federal itemized deductions except:

- All qualified medical expenses are allowed.

- Any charitable donations claimed on the federal return for which an Arizona credit is claimed, must be removed from the Arizona itemized deductions.

- Arizona will allow a deduction for mortgage interest not allowed on the federal return due to claiming a federal mortgage credit.

How to benefit from a Home Office Deduction

11-06-2019Tax InformationA home office deduction can be taken when a taxpayer uses a portion of their home exclusively, and on a regular basis, for any of the following:

- As the taxpayer’s main place of business.

- As a place of business where the taxpayer meets patients, clients or customers. The taxpayer must meet these people in the normal course of business.

- If it is a separate structure that is not attached to the taxpayer’s home. The taxpayer must use this structure in connection with their business

- A place where the taxpayer stores inventory or samples. This place must be the sole, fixed location of their business.

- Under certain circumstances, the structure where the taxpayer provides day care services.

Employee vs Independent Contractor

10-30-2019Tax InformationEmployers, please be aware that just because you think someone is an Independent Contractor, the IRS and Tax Court might not agree.

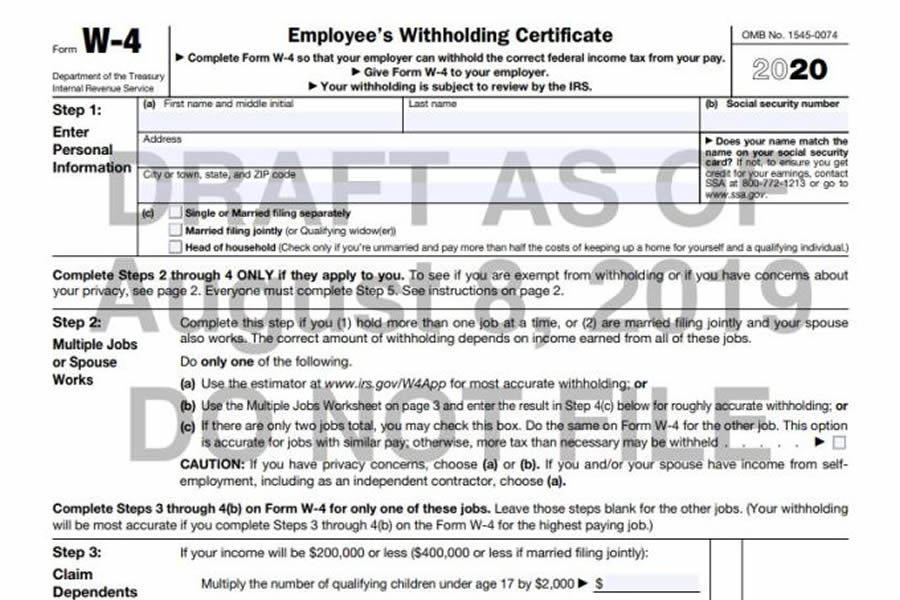

Redesigned W-4 Form

08-13-2019Tax InformationThe Internal Revenue Service released a redesigned Form W-4 for tax year 2020. The redesigned Form W-4 employs a building block approach to replace complex worksheets with more straightforward questions that make it simpler for you to figure a more accurate withholding. The new form uses a more personalized, step-by-step approach.

Employees who have submitted a Form W-4 in any year before 2020 are not required to submit a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

Impact on IRS Operations during Government Shutdown

12-28-2018Tax InformationDue to the current lapse in appropriations, IRS operations are limited. However, the underlying tax law remains in effect, and all taxpayers should continue to meet their tax obligations as normal.

- Individuals and businesses should keep filing their tax returns and making deposits with the IRS, as they are required to do so by law.

- The IRS will accept and process all tax returns with payments.

- Payments accompanying paper tax returns will still be accepted as the IRS receives them.

- Tax refunds will not be issued until normal government operations resume. READ MORE

IRS Proposes Changes to Charitable Contribution Rules related to State Tax Credits

08-27-2018Tax InformationThe IRS proposed legislation on Thursday, August 23, 2018 that would possibly eliminate your ability to use State Tax credits as an Itemized Deduction on your Federal income tax return. If you believe this legislation will become law, here are some quick considerations for you to make by Monday, August 27, 2018. (Yes, you only got 4 days to act)

In Arizona, this proposed legislation would impact donations for state tax credits to:

- Qualified Charitable Organizations (formerly Working Poor)

- Public Schools Activity Fees

- Student Tuition Organizations

- Military Family Relief Fund

- Foster Care

Other states may have programs like Arizona to allow such credits.

READ MORE

2018 Form 1040 to be shorter but with more schedules

06-30-2018Tax InformationThe IRS is still working on a draft version of the 2018 Form 1040, U.S. Individual Income Tax Return. The 1040 will be two half-pages in length, but moves many items formerly on the 1040 to new schedules.

READ MORE

President Trump claims tax cuts will benefit the Middle Class Americans

09-28-2017Tax InformationIs President Donald Trump’s statement earlier this month that “the rich will not be gaining at all with this (proposed tax) plan” true? Will the middle class benefit?

Background

President Trump is looking to overhaul the tax code. He made remarks prior to a September 13 meeting with members from both parties of Congress. The president said he wanted to cut the corporate tax rate from 35 percent to 15 percent and lower individual income taxes.

READ MORE

IRS complies with President Trump’s Executive Order -- will not reject tax returns without health care disclosure

02-20-2017Tax InformationAfter President Donald Trump issued an Executive Order, the IRS announced that it will not reject tax returns just because a taxpayer has not indicated on the return whether the taxpayer had health insurance, was exempt, or made a shared-responsibility payment under Sec. 5000A of the Patient Protection and Affordable Care Act (PPACA).

- The PPACA requires taxpayers who do not maintain minimum essential health coverage for each month of the year and who do not qualify for an exemption to pay a shared-responsibility payment with the filing of their Form 1040, U.S. Individual Income Tax Return.

- Although the health insurance information requirement has been in effect for a few years, the IRS accepted returns that did not contain the information READ MORE

Myths on Trust Taxation

02-11-2017Tax InformationI periodically get inquiries from individuals who think they can avoid income taxes because they have a trust. Trusts are often very good tools to protect your assets; but not always a good tool for simple tax planning strategies. Trusts generally have much lower deductions, compressed marginal tax rates, and a much lower threshold for the net investment income tax. Thus, a trust may incur higher income taxes than an individual may pay.

READ MORE

Some Tax Forms Arizona Department of Revenue are Incorrect

01-31-2017Tax InformationThe Arizona Department of Revenue announced on January 30, 2017 that it sent out some incorrect 1099-G forms for 2015 taxpayers that received refunds.

The erroneous forms included information from the 2014 tax year, and did not include the correct information from the 2015 tax year.

You can still file your 2016 income tax return – Please use your actual 2015 tax return if your 1099-G document is different.

Proposed Revisions to Tuition Tax Credits and Deductions

08-03-2016Tax InformationThe Internal Revenue Service has proposed revisions to tuition tax credits and deductions for individual tax payers. The changes are meant to be in alignment with the Protecting Americans from Tax Hikes (PATH).

Key things to know:

- No deduction or credit will be allowed unless there is a 1098-T, Tuition Statement, received from the eligible educational institution.

- An exception will be made for items not included on the form (e.g. required course materials that qualify for the American Opportunity Tax Credit)

- Form 0198-T should be received by January 31 of the following year

- Reporting will be more specific for qualified tuition and related expenses paid in one year that relate to the academic period beginning in the first three months of the next calendar year. The prepaid amount would be explicitly stated READ MORE