Required Minimum Distribution Formula Change for 2022

08-29-2022Tax InformationThe Internal Revenue Service (IRS) updated its actuarial tables that dictate how much a person is required to withdraw from his or her retirement accounts starting at age 72. This is the first time since 2002. The new tables project longer lifespans. This could be good news for individuals that want to stretch their retirement earnings into the future.

READ MORE

Court case clarifies deductions for vehicle expenses

08-11-2022Tax InformationYou can use a recent Tax Court case ruling to help protect you against the Internal Revenue Service questioning your vehicle expenses. Gonzalez, TC Summary Opinion 2022-13, 7/18/22 ruled that you can deduct vehicle expenses related to a side-gig, as long as you follow strict rules.

What you need to know and do:

Generally, expenses relating to use of a car, van, pickup, etc. used for business are deductible. If you drive your own passenger car to visit clients or customers, you may write off the portion of your vehicle’s costs that is attributable to business use, subject to some special limits. If you use your car 80% for business, you can deduct 80% of the costs.

READ MORE

IRS changes 2022 mileage rates effective July 1,2022

06-21-2022Tax InformationThe Internal Revenue Service announced on June 9, 2022 an increase to mileage rates for 2022 taxes. The changes are just for the final six months of 2022 only. Individuals taking advantage of this deduction will need to break out their mileage into the proper time category.

| Jan-Jun 2022 | Jul-Dec 2022 | |

|---|---|---|

| Business | 58.5¢ | 62.5¢ |

| Medical | 18¢ | 22¢ |

| Charity | 14¢ | 14¢ |

Tax Considerations for selling your home

06-01-2022Tax InformationYou may qualify to exclude from capital gains from the sale of your primary residence if you meet these criteria:

- Ownership test. The homeowner must have owned the home for at least two years of the five-year period ending on the date of the sale.

- Use test. The homeowner must have used the home as their main residence for at least two years of the five-year period ending on the date of the sale.

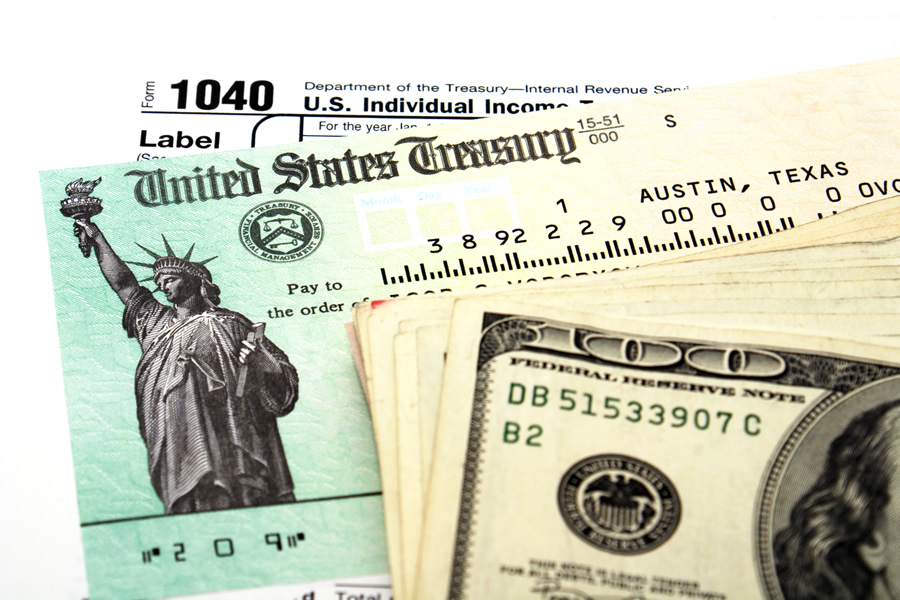

Watch for Economic Impact Payment (Stimulus) letter

12-28-2021Tax InformationThe Internal Revenue Service is issuing information letters to recipients of the third round of the Economic Impact Payments. People receiving these letters to make sure they hold onto them to assist them in preparing their 2021 federal tax returns in 2022.

IRS Letter 6475, Your Third Economic Impact Payment, will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their tax year 2021 tax returns that they file in 2022.

READ MORE

Watch for advance Child Tax Credit Letter

12-28-2021Tax InformationThe Internal Revenue Service is issuing information letters to Advance Child Tax Credit recipients. People receiving these letters to make sure they hold onto them to assist them in preparing their 2021 federal tax returns in 2022.

IRS Letter 6419, 2021 advance CTC, will include the total amount of advance Child Tax Credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance Child Tax Credit payments with their tax records.

READ MORE

Three ways to make the most of your 2021 Charitable Contributions

11-22-2021Tax InformationMany Americans wish to help out their communities and favorite charities through end of year financial support. Are you able to do it more efficiently?

The easiest was to give is through a check or electronic giving portal. Cash comes right out of your bank account. Here are three fairly simple strategies to consider.

READ MORE

Preparing for 2021 End of Year Taxes

11-14-2021Tax InformationTaxpayers, including those who received stimulus payments or advance Child Tax Credit payments, should take steps now to make filing their tax returns easier in 2022. Planning will help taxpayers file an accurate return and avoid processing delays that can hold up refunds, the IRS says.

READ MOREGet a charitable tax deduction benefit without itemizing!

11-07-2021Tax InformationDid you know you can make a $300 donation (or $600 for a married couple filing jointly) and get a tax deduction – even if you do not itemized your deductions?

The IRS has reminded taxpayers that a special tax provision will allow more Americans to deduct up to $600 in donations to qualifying charities on their 2021 federal income tax return. It is just for 2021.

READ MORE

Did you receive an IRS Notice?

07-07-2021Tax InformationThe Internal Revenue Service sent a large number of CP14 notices dated July 5, 2021 to individuals that had an amount due on their 2020 income tax return. These notices appear to be sent in error; however, there are steps you should take to prevent further action and dispute the amount due.

Based on our research and conversations with other CPAs, the IRS has deposited tax payments made on individual’s 2020 income returns; but has not updated individual accounts to credit payments made.

READ MORE

2020 Tax Return Update

04-05-2021Tax InformationAs we begin the month of April, please be assured your 2020 income tax return has been prepared and is awaiting CPA review. You should expect to hear from us soon.

With some of the tax law changes that happened in 2021 that affected 2020, we have been awaiting guidance from the IRS for updated forms and how to report certain items correctly the first time. The tax returns become more complex (e.g., reconciling stimulus payments, cryptocurrency, due diligence reporting for tax credits, etc.) each year and we are attempting to keep everyone in compliance.

READ MORE

What to Do if You are Still Waiting on the Second Coronavirus Economic Stimulus Payment

01-05-2021Tax InformationYou can check the status of both your payments by using the IRS Get My Payment tool. If you have not received your full payment by the time you file your 2020 tax return, you may claim the Recovery Rebate Credit.

For more information, click HERE.