Three ways to make the most of your 2021 Charitable Contributions

11-22-2021Tax InformationMany Americans wish to help out their communities and favorite charities through end of year financial support. Are you able to do it more efficiently?

The easiest was to give is through a check or electronic giving portal. Cash comes right out of your bank account. Here are three fairly simple strategies to consider.

READ MORE

Preparing for 2021 End of Year Taxes

11-14-2021Tax InformationTaxpayers, including those who received stimulus payments or advance Child Tax Credit payments, should take steps now to make filing their tax returns easier in 2022. Planning will help taxpayers file an accurate return and avoid processing delays that can hold up refunds, the IRS says.

READ MOREGet a charitable tax deduction benefit without itemizing!

11-07-2021Tax InformationDid you know you can make a $300 donation (or $600 for a married couple filing jointly) and get a tax deduction – even if you do not itemized your deductions?

The IRS has reminded taxpayers that a special tax provision will allow more Americans to deduct up to $600 in donations to qualifying charities on their 2021 federal income tax return. It is just for 2021.

READ MORE

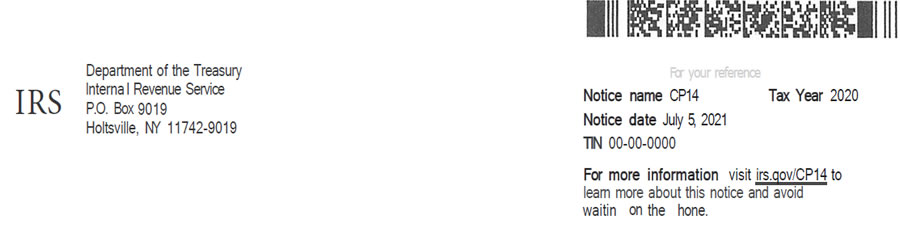

Did you receive an IRS Notice?

07-07-2021Tax InformationThe Internal Revenue Service sent a large number of CP14 notices dated July 5, 2021 to individuals that had an amount due on their 2020 income tax return. These notices appear to be sent in error; however, there are steps you should take to prevent further action and dispute the amount due.

Based on our research and conversations with other CPAs, the IRS has deposited tax payments made on individual’s 2020 income returns; but has not updated individual accounts to credit payments made.

READ MORE

Advance Child Tax Credits are coming!

06-30-2021Children & StudentsThe American Rescue Plan Act of March 2021 changed a number of provisions for the child tax credit – these tax changes are temporary and only apply to the 2021 tax year.

- Raised the age of qualifying children to 17 from 16

- Increased the amount for certain taxpayers

- Made the credit fully refundable (meaning you can receive it even if you don’t owe the IRS)

- May be partially received in monthly cash payments

2020 Tax Return Update

04-05-2021Tax InformationAs we begin the month of April, please be assured your 2020 income tax return has been prepared and is awaiting CPA review. You should expect to hear from us soon.

With some of the tax law changes that happened in 2021 that affected 2020, we have been awaiting guidance from the IRS for updated forms and how to report certain items correctly the first time. The tax returns become more complex (e.g., reconciling stimulus payments, cryptocurrency, due diligence reporting for tax credits, etc.) each year and we are attempting to keep everyone in compliance.

READ MORE

What to Do if You are Still Waiting on the Second Coronavirus Economic Stimulus Payment

01-05-2021Tax InformationYou can check the status of both your payments by using the IRS Get My Payment tool. If you have not received your full payment by the time you file your 2020 tax return, you may claim the Recovery Rebate Credit.

For more information, click HERE.

Significant Tax Changes

12-29-2020Tax InformationHere is a review of significant changes that may impact you for the tax year 2020 filing season from the:

- Coronavirus Aid, Relief and Economic Security (CARES) Act

- Families First Coronavirus Response Act

- Setting Every Community Up for Retirement Enhancement (SECURE) Act

- Taxpayer Certainty and Disaster Tax Relief Act of 2019.

Helpful tips for your 401(k) and Individual Retirement Accounts (IRAs)

12-28-2020RetirementDo you have an employer 401(k) plan or other retirement plan assets? Should you consolidate accounts? Here are some ideas and recommendations to consider.

Benefits of Company 401(k) plans

- If you leave your money in a company 401(k) plan rather than rolling it into an IRA) is no required minimum distributions (RMDs) if the account owner is still working. Generally, account holders must start withdrawing from their retirement accounts at age 72. The RMDs at age 72 apply only to traditional IRA accounts and not to Roth IRA accounts. READ MORE

How to Avoid Identity Theft

12-15-2020Debt & CreditYou probably already know these things, but it is always a good reminder to remember the following items to minimize the risk of your identity being stolen. The time and money you will spend in recovery is expensive – and potentially avoidable.

- Passwords - Using passwords that include a mix of letters, numbers and special characters makes it harder for identity thieves to crack these codes. Consider a phrase instead of a password and intertwine numbers and/or characters (e.g. Lov3MyK!d5). Another trick is to use three unrelated words (e.g. LatteSleepFrog). READ MORE

Are expenses paid with PPP loan proceeds deductible?

11-19-2020Tax InformationThe U.S. Treasury Department and Internal Revenue Service (IRS) released guidance yesterday (November 18, 2020) clarifying the tax treatment of expenses where a Paycheck Protection Program (PPP) loan has not been forgiven by the end of the year the loan was received.

Since businesses are not taxed on the proceeds of a forgiven PPP loan, the expenses are not deductible. This results in neither a tax benefit nor tax harm since the taxpayer has not paid anything out of pocket.

READ MORE

IRS view of Vacation Home Losses

10-22-2020Tax InformationGenerally, if you rent out a vacation home while you not using it personally, you can deduct expenses to offset taxable income from the rental. This includes mortgage interest, property taxes, repairs, utilities, insurance, etc. (Mortgage interest and property taxes are subject to additional rules for a qualified personal residence).

You might even be able to deduct a loss on your income tax return in that year if your personal use of the vacation home does not exceed the greater of (a) 14 days or (b) 10% of the time the home is rented out.

READ MORE